RELATED NEWS

- Spanish furniture trade: 2021 annual report

- WAYFAIR and FURNITURE FROM SPAIN strengthen their collaboration in the e-commerce market

- Spanish furniture trade: 2019 annual report

- The Spanish furniture export increases by 2.5% in the first half of 2018

- Spanish furniture trade: 2017 annual report

TAGS

- exports

- figures

- furniture exports

- furniture imports

- furniture trade

- spanish furniture trade

- statistics

Spanish furniture trade: 2019 annual report

The Spanish National Association of Furniture Manufacturers and Exporters (ANIEME) has just released the Spanish furniture foreign trade report for the year 2019. Figures reveal that, during this period, Spain’s exports of furniture have grown by 4.7%, exceeding 2,318 million euros. It is worth highlighting the increase in Spanish furniture exports to markets as diverse as the United States, Morocco, France and Portugal.

Insights on global furniture development

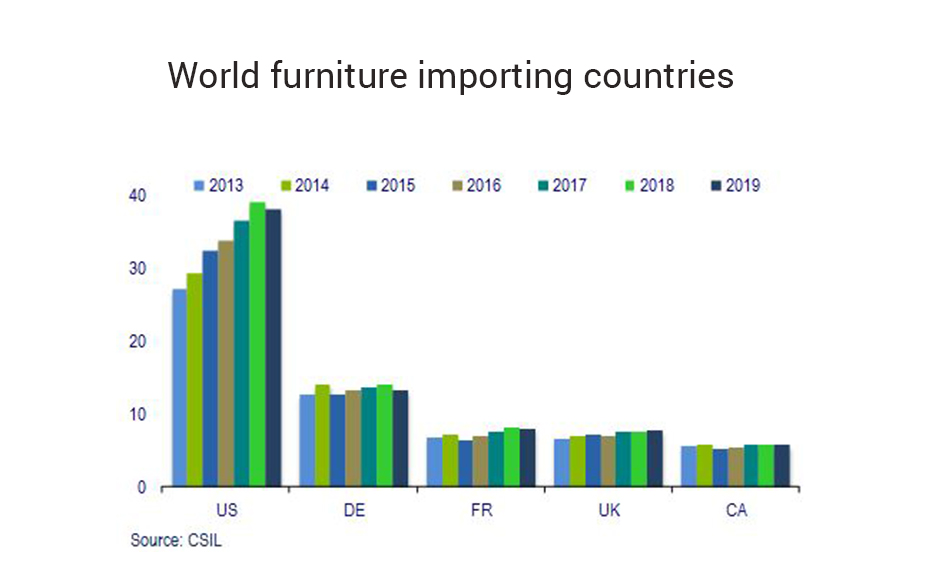

According to CSIL World Market Overview 2020-2022, over the past ten years international furniture trade has grown faster than furniture production. In 2018 and 2019, furniture accounted for approximately 1% of global international trade of manufactured goods amounting to around US$ 150 billions.

The leading furniture importing countries are the United States, Germany, France and the United Kingdom. On the export front, the leading players are: China, Germany, Poland, Italy and Vietnam, with fastest growth rates recorded among Asian exporting markets. About two third of the US imports was from Asia (China, Vietnam, Malaysia), although the share of China is decreasing because of trade tensions between the two countries.

The world market for high-end furniture is worth approximately US$ 50 billion, including design furniture and contract furniture for high-end projects, such as five stars hotels, yachts, luxury private villas, etc. that represent around 30% of the market. The world market for high-end furniture is a concentrated one: the top 10 countries in the market absorb over 80% of the total high-end furniture, being the North America, Asia and Pacific, including China, the main markets.

The current scenario for 2020 and following years is heavily marked by downside risked due to the Coronavirus epidemic and the negative developments of tariff wars and geopolitical turbulence, which are likely to have negative effects on international trade and increase the level of uncertainty among operators.

Exports of Spanish furniture closed 2019 with a positive balance

During 2019, sales of Spanish furniture abroad exceeded 2,318 million euros, registering a significant growth of +4.7%, with respect to the recorded sales from the previous year.

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 | |

|

January-December |

1,692 |

1,857 |

2,064 |

2,113 |

2,215 |

2,318 |

SOURCE: ESTACOM/ ANIEME *Millions of Euros

2019: Spain’s imports of furniture rise by 3.4%

Over last year, Spain imported over €3,180 million of furniture, representing a +3.4% growth when compared with last year’s statistics. All in all, this data reveal that Spain closed the year with a trade deficit of 861 million euros and a coverage rate of 72.9% of imports by the exports.

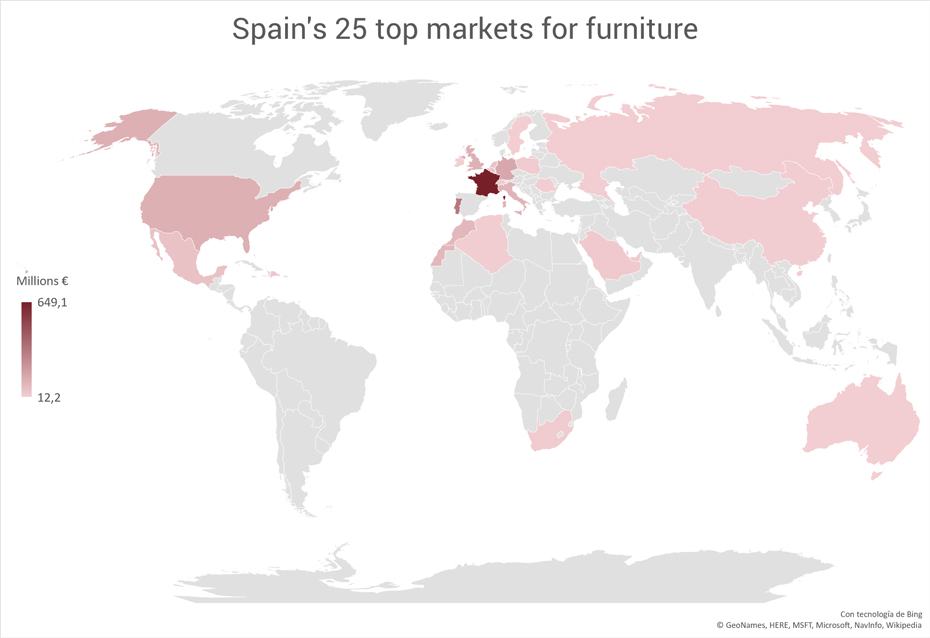

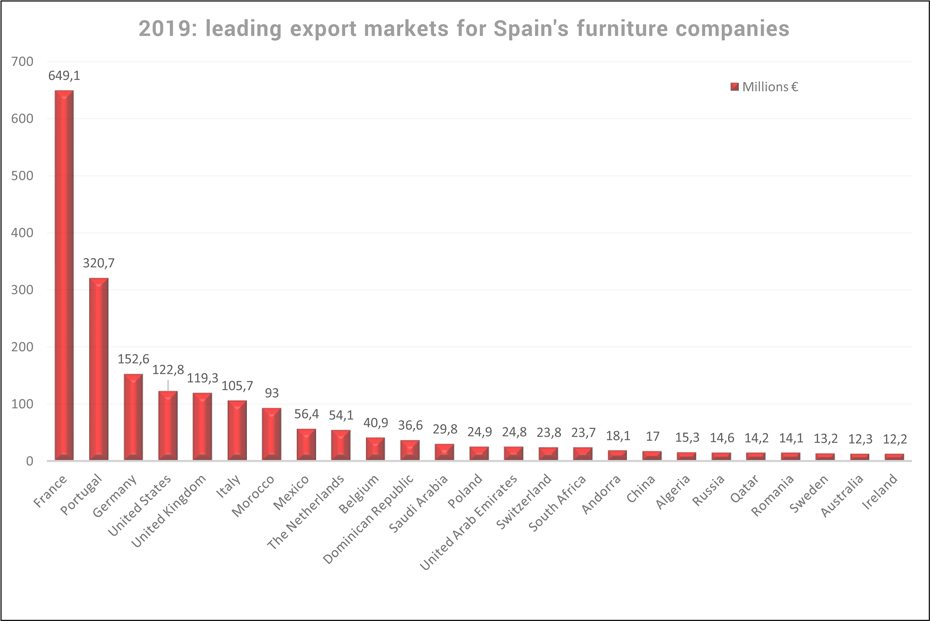

Exports by destination: Spain’s main markets for furniture

With a diverse and complete offer in the furniture sector, Spain continues to consolidate its presence in the biggest EU countries: France, Portugal, Germany and the United Kingdom concentrate the 53.5% of the Spanish furniture exports, more than a half of the total exported, and rank among the five first destination markets. All of them have increased their imports from Spain confirming a trend that has consolidated in recent years.

| Countries | 2018 | 2019 | % of total | ∆% 19/18 |

| Francia | 595.654,5 | 649.089,5 | 28,0% | 9,0% |

| Portugal | 272.970,3 | 320.660,3 | 13,8% | 17,5% |

| Alemania | 150.629,7 | 152.596,0 | 6,6% | 1,3% |

| Estados Unidos | 116.210,6 | 122.774,5 | 5,3% | 5,6% |

| Reino Unido | 114.402,3 | 119.311,5 | 5,1% | 4,3% |

| Italia | 95.769,3 | 105.684,6 | 4,6% | 10,4% |

| Marruecos | 84.255,0 | 93.049,8 | 4,0% | 10,4% |

| México | 59.493,7 | 56.435,4 | 2,4% | -5,1% |

| Países Bajos | 76.177,3 | 54.109,1 | 2,3% | -29,0% |

| Bélgica | 38.970,9 | 40.879,2 | 1,8% | 4,9% |

SOURCE: ESTACOM/ANIEME *Thousand of Euros

The growth rates of Portugal, Italy and Morocco are particularly remarkable as these countries have increased their imports from Spain by two digits.

With an increase by +17,5%, Portugal confirms itself as the 2nd destination market for Spanish products, well above Germany and the United Kingdom that increased their imports of Spanish furniture by +1.3% and +4.3%, respectively. The raise in export to UK reflects that, during 2019, Brexit did not negatively affect Spanish furniture exports as it did with other products and consumer goods.

On the other hand, considering that a strong dependency on a market or the excessive market concentration in the UE countries is not positive, Spanish brands have striven to diversify their destination markets by increasing their presence on other areas and continents.

As a result, Spanish furniture has gained important positions in the United States, Morocco and Mexico, where CEO of Spanish furniture companies have focused their market strategies for both the residential and contract markets.

This way, an encouraging increase has been registered in exports to North America. With imports of Spanish furniture growing by +5.3% to 122,8 million euros, the U.S.A. earned the 4th position in the ranking and it is now the first international destination market just behind the top UE countries. Exports to Mexico have slightly decreased (-5.1%) but the country still ranks among the first ten occupying the 8th place in the ranking.

As for Latin America and the Caribbean, according to a CSIL market research, around 30% of the furniture consumed in this area is imported, being Mexico, Panama, Brazil and Chile the major importing countries. Considering that the furniture imports from the countries of the area are growing and amount to around USD 4.5 billion, Spanish companies have worked hard to increase their export share participating also in major hospitality projects. Besides Mexico, Spain has achieved good results in the Dominican Republic, which ranks 11th having imported furniture from Spain worth 36.6 million euros (+50.0%).

Credits:

ANIEME – Spanish National Association of Furniture Manufacturers & Exporters

CSIL, World Furniture International Market Rewiew, 85 March 2020