RELATED NEWS

- Spanish furniture trade: 2021 annual report

- WAYFAIR and FURNITURE FROM SPAIN strengthen their collaboration in the e-commerce market

- Spanish furniture trade: 2019 annual report

- The Spanish furniture export increases by 2.5% in the first half of 2018

- Spanish furniture trade: 2017 annual report

TAGS

- exports

- figures

- furniture exports

- furniture imports

- international trade

- spanish furniture

- statistics

Spanish furniture trade: 2017 annual report

Insights on global furniture development

According to CSIL World Furniture Outlook 2018, world furniture production amounted to over 00 billion last year, up 3.0% on the previous year and cumulatively growing by 25% in the last decade (in current USD).

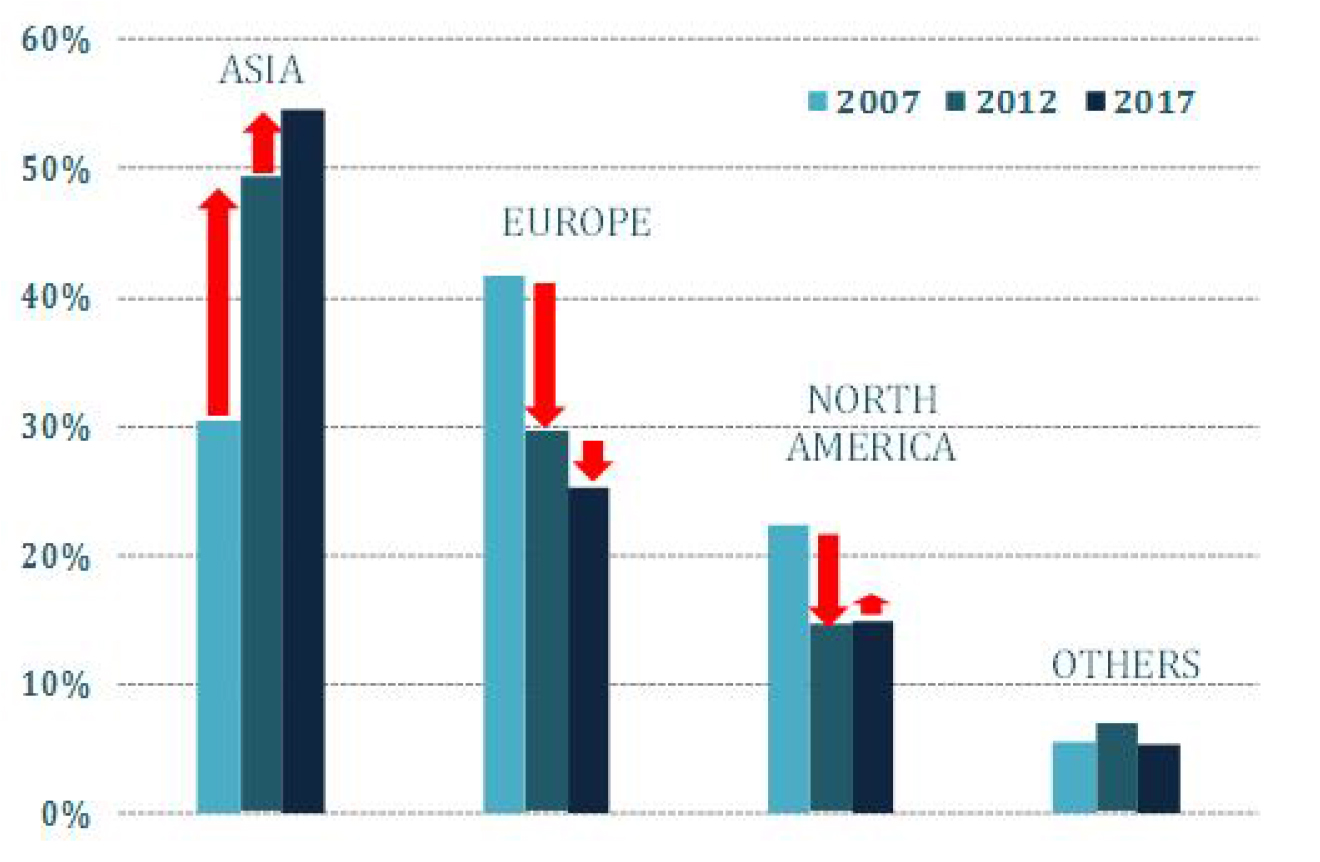

Europe is a leading player in the furniture industry, being the largest producing region in the world just after Asia, which concentrates over half of world production. CSIL estimates that Europe accounts for around one quarter of the total sector output; it was around 40% a decade ago.

Shares of regions on world furniture production. % on value data. SOURCE: CSIL

Although hit by the crisis, the European furniture market is now in a process of recovery, while facing some new challenges like: competition within the area and market fragmentation, import pressure, durable employment, rising raw material costs and innovations protection. According to EFIC – European Furniture Industries Confederation -, the EU furniture sector currently employs over 1 million people in almost 200,000 companies, most of which are SMEs.

Currently, international trade is worth around 40 billion and is set to grow in the coming years up to 2020. The leading importing countries are the United States, Germany, the United Kingdom and France. Furniture exports from China, the world’s top exporter, more than doubled between 2009 and 2015. They are currently worth some 0 billion annually and have shown growth over recent years, albeit at moderate rates. The other large furniture exporters, like Germany, Italy and Poland, also continued to record growth in 2017.

Exports of Spanish furniture close 2017 with a positive balance

During 2017, sales of Spanish furniture abroad amounted to €2,113 million, corresponding to an encouraging rise of 2.4%, with respect to the recorded sales from the previous year.

|

|

2014 |

2015 |

2016 |

2017 |

∆% 17/16 |

|

January-December |

1,692 |

1,857 |

2,064 |

2,113 |

2.4% |

*Millions of Euros SOURCE: ESTACOM

2017: Spain’s imports of furniture rise by 3.4%

Over last year, Spain imported over €2,956 million of furniture, representing a 3.4% growth when compared with last year’s statistics. With this data, it can be ascertained that Spain closed the year with a trade deficit of €843 million revealing a coverage rate of 71.5% of imports by the exports.

Exports by destination: Spain’s main markets for furniture

With a diverse and complete offer in the furniture sector, Spain continues to consolidate its presence in the biggest EU countries: France, Portugal, Germany and the UK, which rank as the top 4 countries among Spain’s major markets and have a concentration of 49.0% of Spanish exports. It must be highlighted that, with the exception of Germany, the main destination markets of the Spanish furniture offer have increased their purchases.

Taking a look at the major markets, France stands out as the top export market for Spain’s furniture offer. French imports of Spanish furniture amounted to over €533 million, giving it a share of 25.2%, meaning that it consumes more than Portugal, Germany and the UK combined. France is therefore of top interest as a crucial market for the Spanish furniture industry, and Spain should continue to invest in this country and reinforce its presence to maintain its elevated market share.

Spanish brands presenting at Maison&Objet in Paris, France, earlier this year

Despite this, it is also important for Spain to diversify their destination markets in order to stay competitive and relevant within the international market for furniture by increasing its presence in other countries and continents. As a result of this, Spain has also been strengthening its presence in markets that hold a lower share, gaining important positions in the USA, Morocco, Mexico, UAE, Turkey and China, where Spanish furniture companies have focused their marketing strategies in both the residential and contract markets. With imports of Spanish furniture growing by 7.3% to €105.5 million, the United States has earned the 5th position in the ranking and it is now the first international destination just behind the EU countries.

Spanish brands presenting at ICFF in New York, USA, last year

Imports of Spanish furniture grew significantly in Asia, with an increase of 17.1% in the United Arab Emirates, 79.5% in Turkey and 99.5% in China. In years to come, further penetration of these markets will be necessary to maintain a constant growth and its reputation as a worldwide exporting country of furniture.

Top furniture supplier countries

Country ranking: Spain’s imports

|

|

2016 |

2017 |

Overall % |

∆% 17/16 |

|

China |

609,356.4 |

657,743.9 |

22.3% |

7.9% |

|

Portugal |

440,080.3 |

409,791.9 |

13.9% |

-6.9% |

|

Germany |

297,595.0 |

298,020.4 |

10.1% |

0.1% |

|

Italy |

252,260.9 |

236,625.1 |

8.0% |

-6.2% |

|

Poland |

276,748.0 |

207,848.1 |

7.0% |

-24.9% |

|

France |

164,517.5 |

176,506.4 |

6.0% |

7.3% |

|

Morocco |

98,643.3 |

123,903.5 |

4.2% |

25.6% |

|

Romania |

81,421.0 |

97,288.9 |

3.3% |

19.5% |

|

Slovakia |

57,858.1 |

78,349.6 |

2.7% |

35.4% |

|

Vietnam |

36,427.5 |

50,342.2 |

1.7% |

38.2% |

|

TOTAL |

2,857,612.5 |

2,956,049.3 |

100% |

+ 3.4% |

* Thousands of euros SOURCE: ESTACOM

As we can see, in the last year, Spain’s imports of furniture rose by 3.4% overall. It is worth highlighting that China has recovered as a top exporter of furniture to Spain, re-establishing its growth in 2017 with a 7.9% increase (when compared with the previous period at only 2.2%).

In contrast to this, the next top exporters to Spain are primarily European countries: Portugal, Germany, Italy, Poland and France; which signifies that not all of Spain’s imported furniture is of the “low cost” nature.

Visitors getting ideas at the 2018 edition of the Salone del Mobile.Milano in Italy last month

All in all, owing to Spain’s continued commitment to its internationalising activities within the sector, combined with the furniture manufacturers’ dedication to fulfilling high expectations of quality and design, Spain’s exports of its furniture offer have continued to grow prosperously.